Recommended Insurance For Restoration Contractors

Recommended Insurance For Restoration Contractors [pdf-embedder url=”https://armr.net/wp-content/uploads/2023/04/Recommended-Insurance-for-Restoration-Contractors.pdf” title=”Recommended Insurance for[…]

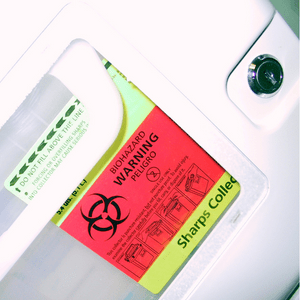

Managing the Environmental Risks In Healthcare Facilities

Managing the Environmental Risks in Healthcare Facilities By David Dybdahl Mention[…]

Getting Free Insurance: A Play Out of Insurance Company Playbooks

Getting Free Insurance: A Play Out of Insurance Company Playbooks Restorers[…]

Managing the Risks of Resiliency-Related Services

IRMI Article By David Dybdahl March 2021 Managing the Risks of[…]

Proactively Manage COVID-19 Risks in the Built Environment

Proactively Manage COVID-19 Risks in the Built Environment By: David Dybdahl[…]

Mold Assessors: Surviving a Deposition

[pdf-embedder url=”https://armr.net/wp-content/uploads/2020/08/Mold-Assessors-Surviving-a-Deposition-.pdf” title=”Mold Assessors Surviving a Deposition”]

COVID-19 WORK: IS IT WORTH RISKING YOUR BUSINESS?

COVID-19 WORK: IS IT WORTH RISKING YOUR BUSINESS? Offering COVID-19 services[…]